Business Insurance in and around Ansonia

Looking for protection for your business? Look no further than State Farm agent Anne Coppola!

This small business insurance is not risky

Insure The Business You've Built.

When you're a business owner, there's so much to focus on. You're not alone. State Farm agent Anne Coppola is a business owner, too. Let Anne Coppola help you make sure that your business is properly protected. You won't regret it!

Looking for protection for your business? Look no further than State Farm agent Anne Coppola!

This small business insurance is not risky

Keep Your Business Secure

If you're looking for a business policy that can help cover accounts receivable, extra expense, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

It's time to contact State Farm agent Anne Coppola. You'll quickly find out why State Farm is one of the leaders in small business insurance.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

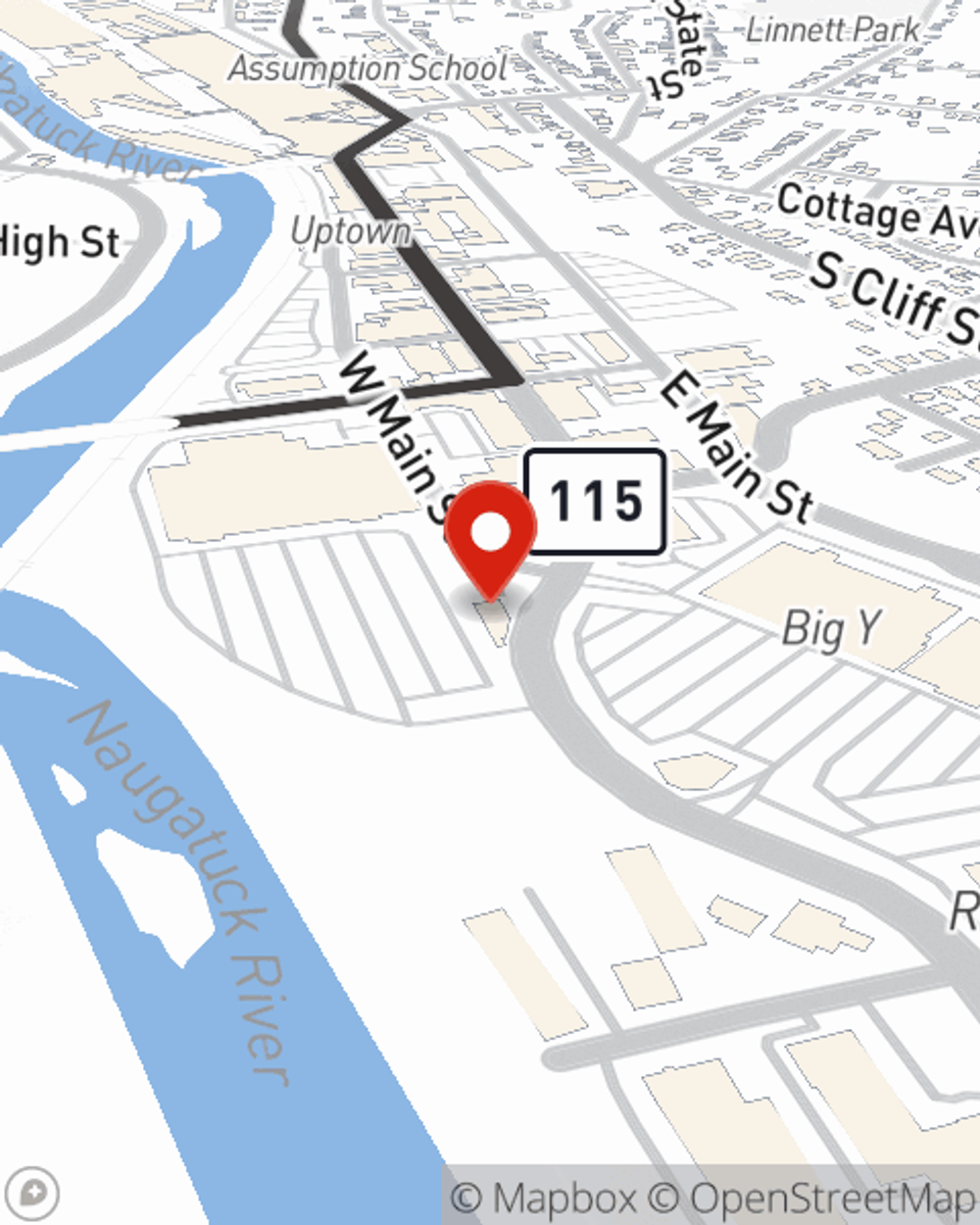

Anne Coppola

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.